Capacity at what cost: How do the latest Capacity Market Auctions impact you?

The most recent round of Capacity Market auctions have now concluded, offering greater clarity on the costs of the scheme for both the coming year and further out to 2024/25.

Amid headlines proclaiming the record high clearing prices and concerns about the cost of the scheme for end users, what do the auction results mean for your business?

Inspired Energy’s capacity market expert and head of Demand Side Response, Eamonn Bell, explains here.

The Capacity Market in a nutshell

The Capacity Market (CM) is designed to ensure security of supply. Generators, and those able to provide demand side response, enter auctions to win contracts which will pay a fixed sum in return for a commitment to generate (or reduce demand) at times of high system stress in a given ‘delivery year’, which runs from the 1st October to the 30th September.

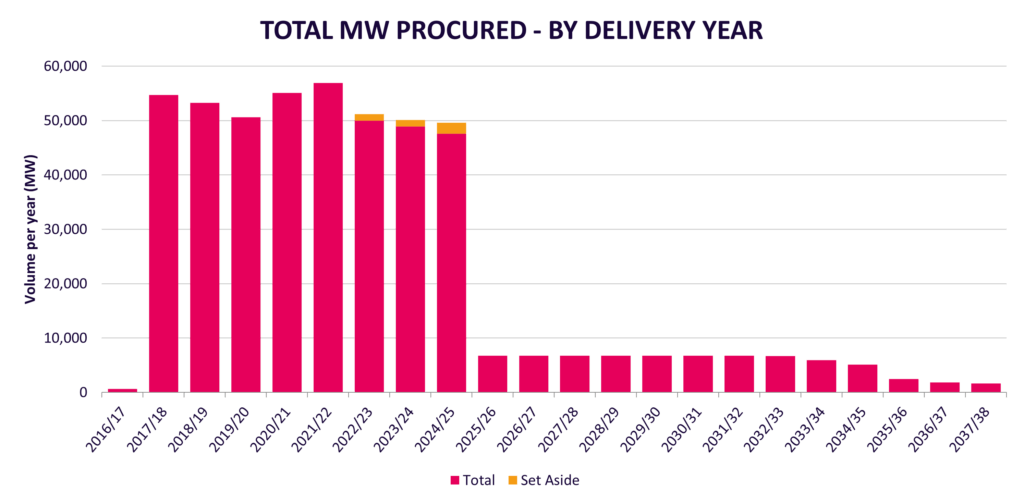

The bulk of the capacity for each delivery year is forecast and secured four years in advance (in ‘T-4’ auctions), with a ‘top up’ secured closer to time to correct those forecasts (in ‘T-1’ auctions).

These take place in the 12 months leading up to a new delivery year and account for a small fraction of the total Capacity volume secured each year by National Grid.

March CM auctions

This month, auctions took place for T-1 (2021/22) and T-4 (2024/25).

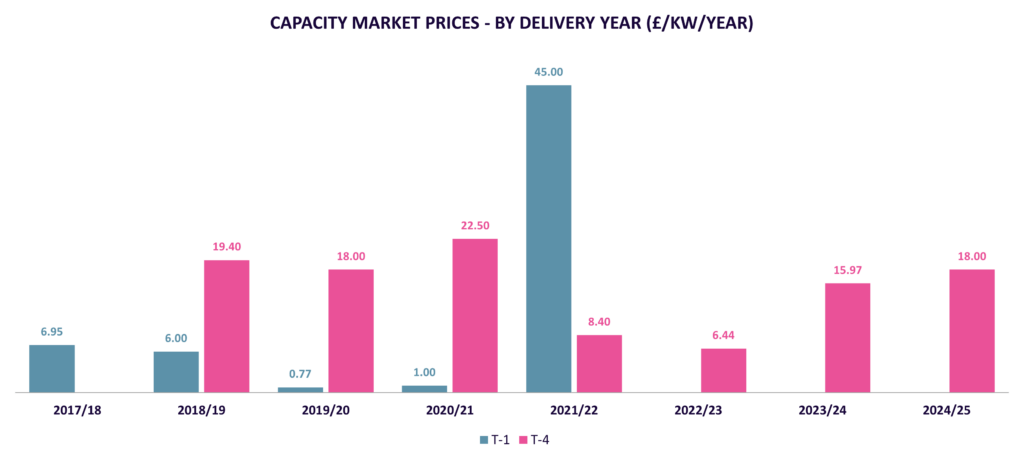

The final clearing price for the T-1 2021/22 auction was £45/kw/year.

This was a significant increase on recent auctions which had delivered exceptionally low clearing prices: the last T-1 auction for delivery this winter just gone cleared at only £1/kW/year.

The T-4 2024/25 auction cleared at the price of £18/kW/year, which was a slight increase on last year’s T-4 clearing price of £15.97/kW/year for delivery in 2023/24 and significantly higher than the record low T-4 2022/23 auction that cleared at £6.44/kW/year.

However, the target price for every one of the 12 Capacity auctions so far conducted has been £49/kW/year, meaning this T-4 auction is another case of slight over-procurement at a much lower than hoped for price.

T-1 auction: analysis

The 2021/22 T-1 auction was slightly unusual, as National Grid planned to procure up to 2400MW – six times the capacity it had originally planned to secure.

This change in approach was caused by growing concerns around the ability of existing CM contract holders to deliver capacity when required: Drax plans to close its coal-fired generation in April 2021, despite holding CM contracts until September 2022, and other participants such as EDF’s nuclear units and Calon’s gas plants may also struggle to ensure availability during the 2021/22 period.

As a result, National Grid decided to procure an additional 2GW of capacity, on top of the 0.4 GW initially planned for the auction, to ensure that sufficient capacity will be in place to match demand across the full delivery year.

Higher clearing prices obviously mean higher prices for consumers – however, this was a top up auction and the bulk of the capacity for the 2021/22 delivery year has already been secured at the far lower price of £8.40/kW/year in the related T-4 auction.

The T-1 auction secured 2,252MW, compared to the 50.4GW cleared in the T-4 auction for 2021/22 at a far lower price.

Whilst the T-1 clearing price does mean total costs for the coming delivery year will be higher, the actual impact of this ‘top up’ auction doesn’t mean the entire cost of Capacity for next winter will catapult.

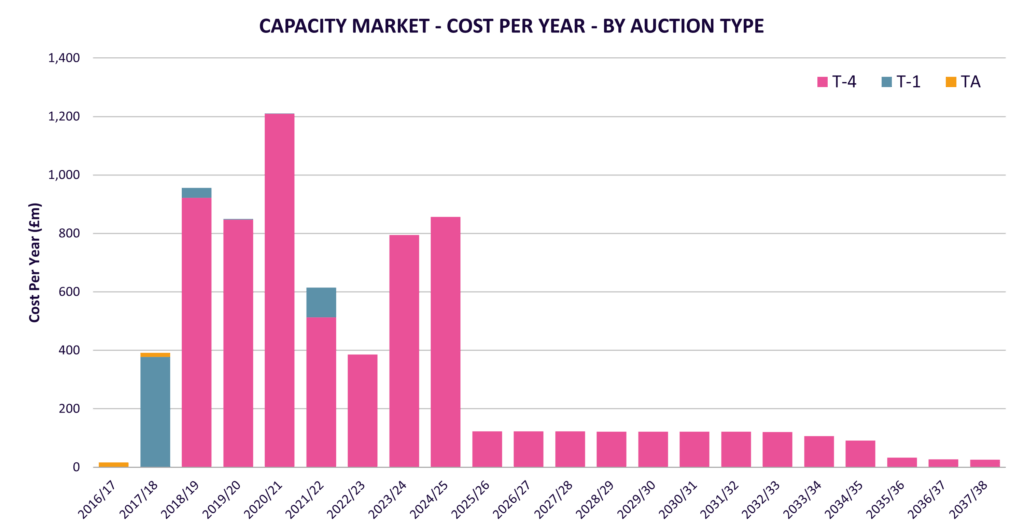

The lion’s share of the Capacity costs – and therefore charges faced by the consumer – are a result not of T-1 auctions but of T-4 auctions.

What does it mean for business energy supply next year?

The 2021/22 T-4 auction clearing price was £8.40/kw/year for 50.4GW, meaning a total cost of £423.4million per year.

The contracts awarded in the T-1 auction will add an additional £112.5million onto the cost of the scheme – adding around 25% more onto the total cost of capacity for this delivery period.

However, this is still around half the cost of CM charges for the current 2020/21 period. This year, consumers will be paying £1,180million; the T-4 auction for 2020/21 secured 52.4GW of capacity at a clearing price of £22/kw/year, creating record high costs for end users.

This means the current 0.54p/kWh charge in 2020/21 should reduce to around 0.217p/kWh for the October 2021 – September 2022 delivery year.

What does it mean for demand side response providers?

Those businesses with on-site generation and flexible capacity who participate in Demand Side Response schemes and secured a contract will be pleased with the auction results.

It provides a more compelling financial case for businesses weighing up investment in technology that would enable them to participate in the scheme.

A 10MW CHP plant awarded a contract in the T-1 auction as a Generating capacity unit could expect to receive in the range of £300k-£400k over the course of the 2021/22 delivery year (its volume would be de-rated to 90%, meaning payment would be received for 9MW), providing it delivers capacity when required.

A customer offering to reduce demand via a DSR capacity unit could expect around £25k per MW they make available, due to how load reduction is de-rated in this delivery year.

T-4 auction: analysis

The T-4 auction cleared in the expected range, with a final price of £18/kW/year. Demand side response did particularly well in the auction, representing over 27% of contracts awarded.

The amount of volume participating in the auctions was far greater than the capacity Grid sought to procure, helping to drive down prices towards the lower end of expectations.

National Grid has conducted seven T-4 auctions to date and each of those auctions have been 25-50% over-subscribed when the starting pistol was fired.

Capacity market participation is not a last-minute thing, with a month-long prequalification process the summer prior to each auction.

This tells us that there is more than enough capacity available to National Grid to manage system constraints.

Future cost of the CM

The Capacity Market mechanism seeks to ensure security of supply into the future as well as providing short term assurance that the lights will stay on.

National Grid assert that a new gas power plant can be built with money from the Capacity Market if the auction clears at £49/kW/year.

This is called the Cost of New Entry (CONE), and is the price that National Grid are happy to pay for their target volume each auction. We can see that all the T-4 auctions have cleared well below the value of CONE.

It will take the closure of more large coal and perhaps nuclear plants to bring the clearing price of the Capacity auctions up towards the value of CONE.

As this scenario plays out, we will see that each auction is not so over-subscribed and the mechanics of supply and demand can play out to raise the clearing price.

For the time being, we can expect the T-4 auctions for some years to come to clear in the £10-£25/kW/year range.

To understand what the impact of the CM auctions will be on your budgets, or for a review of your portfolio to identify opportunities for energy reduction or demand optimisation, speak to Wayne Brown on 01772 689250 or by emailing wayne.brown@inspiredenergy.co.uk

By Inspired Energy plc

898 Views

Recent Posts

- Ecodesign for Sustainable Products Regulation – what will this new legislation mean for your business?

- Right to Repair Directive – what will this new legislation mean for your business?

- Empowering Consumers for the Green Transition Directive – what will this new legislation mean for your business?

- What is the Circular Economy Action Plan and why does it matter to businesses outside the EU?

- The pitfalls of preliminary agreements

Back to News >