Interesting times lie ahead for the UK life science industry

Did you know that the life sciences industry is worth around £50 billion in the UK? As a result, if you own a life science business, there are likely to be a number of activities you may be involved with that could help you obtain R&D tax credits:

● Creating new devices

● Changing processes within manufacturing or repurposing existing ones

● Creating a new facility or production line

● Approval to sell a certain drug

● Scaling up processes

● Developing hardware and software

UK life science sector: a brief overview

In the UK, the life sciences sector generates around £64 billion of turnover and employs around 233,000 staff and scientists. The life sciences sector in the UK is a sector that sees a large amount of investment. The sector sees the development of new technologies on a regular basis. The life science sector in the UK is arguably a global leader. Which is why undeniably, businesses within this sector are often highly successful when making R&D claims.

Why is finance important to the success of the life science industry?

Over recent years, funding within the life sciences industry has begun to slow down. Funds are beginning to decline and significant fresh funds are not being generated. Ultimately, the life sciences sector is critical not only for the UK economy, but also for human health. In the 21st century, the development of drugs, treatments and medical advancement has progressed at an immense rate. However, worryingly, this may not be sustained in the current situation. Which is disappointing for millions of people with chronic illnesses.

What are the current finance options for the life science industry?

There are a number of potential finance options available for businesses within the life science industry. Such as:

Grants and awards. There are a range of companies in the UK which offer funding for small and medium sized enterprises. To help businesses create solutions for a variety of challenges regarding health care.

Innovation vouchers. Money provided by universities which provide a boost for businesses in early stages of formation.

Academic partnerships. Sometimes, universities lack expertise to launch projects they may have planned. Growth programmes can provide extra skills and support for businesses.

Charitable partnerships. There are many charitable companies which are willing to support businesses. For example, companies that will fund certain research projects.

Crowdfunding. Small donations from individuals which can potentially add up to a large amount.

Equity funding. Provides access to funding along with access to business people who can further coach and develop a business.

Risk share. Strategic partnerships that support businesses both financially and in other resources.

Post trading benefits. Once a business starts trading, the number of options increase significantly. Such as funding from loan finance.

What are R&D tax credits and why should I consider them?

They are a tax relief provided by the government which reward UK businesses which heavily innovate. I.e. businesses that spend a significant amount of money on things such as new product development and processes. Or the development of existing ones. Moreover, as much as 33p in every £1 can be claimed back.

Why should I use an expert?

As you are probably aware, there are many parts of your business that you can become involved in. Such as sales, marketing and finance. If you have reasonable knowledge of these areas. However, if you lack skills and experience in a particular area, you would probably need to outsource the work to an expert. The same philosophy applies to R&D tax claims. Why put yourself through the hassle and stress of trying to complete a claim when you are finding it difficult? Importantly, if information is presented incorrectly or is inaccurate, this can invalidate the claim altogether.

Why should I use Lumo to do my R&D tax credits?

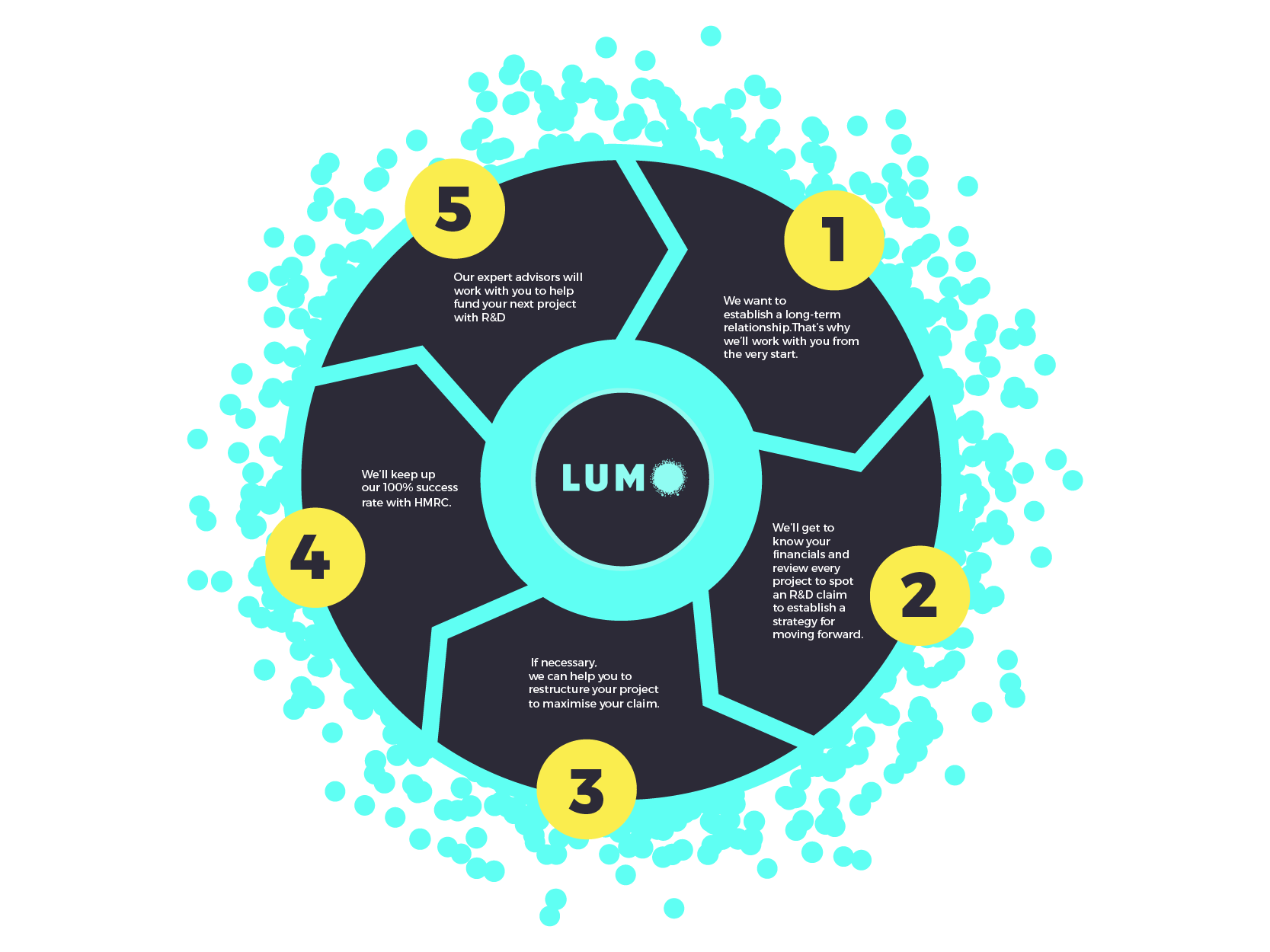

Lumo are experts in R&D tax claims. Unlike accountancy practices who offer a range of different services, Lumo only offer R&D. So we consider ourselves to be experts in the field. We are proud to say that we have helped over 200 companies. And have recovered over £15m tax relief in total over the past decade.

We make it easy for our customers. We really get to know your business. Then we work alongside HMRC on your behalf. And we are capable of doing all the legwork, so you don’t have to.

Ultimately, we want to submit an R&D claim that is successful and returns you with the R&D tax credits that you are entitled to.

External URL: www.lumo.tax

By Lumo Tax

758 Views

Recent Posts

- Cooperation vs True Collaboration in Construction – is the Industry Getting it all Wrong?

- Explore the Impact of Verifying Carbon Capture Technologies

- ITS wins Supplier of the Year at the ISPE UK Affiliate Annual Awards

- Cembre MG4 | The Newest Thermal Printer for Identification & Labelling | Available From Thorne & Derrick

- Share your expertise at ICPVT15: International Conference on Pressure Vessel Technology

Back to News >